Pool LP

Dual Asset deposits

Dual asset deposit enables a user to choose the maximum amount of tokens they're willing to deposit into a pool. Calculation of exactly how many tokens are needed is done at the moment of processing the transaction, validating that it does not exceed the maximum amount of tokens the user is willing to deposit.

Single asset deposits

Single asset deposit converts tokens to the correct pool weight and adds them to the pool in one transaction. Swap fees apply.

Since the tokens are swapped during the deposit phase, when exiting the LP position, the user receives equivalent amounts of each token in the pool in proportion to the pool weight.

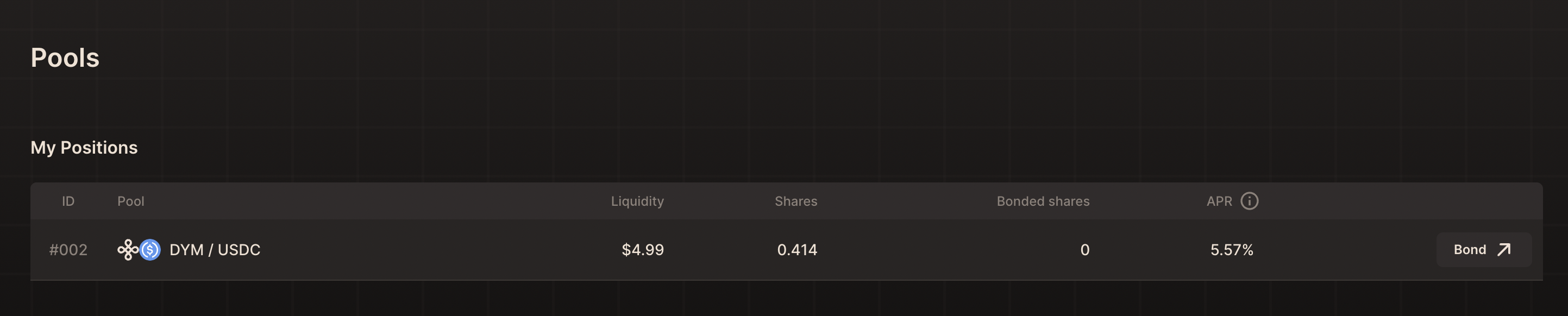

LP Bonding

After depositing assets into a specified liquidity pool, a user must bond their tokens to be eligible for incentives.

LP unbonding

To unbond liquidity pool tokens, a user must select their bonded position and enter an amount of liquidity pool tokens to unbond. This process takes one minute to complete onchain.

Exit a pool

To exit a pool position, a user must first unbond their liquidity pool tokens (if applicable). The user then provides the minimum amount of tokens they are willing to receive as they are returning their shares of the pool.

There is no additional exit fee for users to exit their liquidity pool position.

Dymension’s embedded Automated Market Maker (AMM) charges two main types of fees LP Swap Fee and Protocol Swap Fee. Fees are set globally by Dymension's governance, the same fee rate applies uniformly across all liquidity pools of the same type (i.e. standard pools).

LP Swap Fee

LP swap fees are set at 0.20% for standard liquidity pools. LP swap fees are automatically reinvested into the liquidity pool, increasing the pool’s overall balance. Liquidity providers can withdraw the accumulated fees by redeeming their LP tokens.

Protocol Swap Fee

Protocol swap fees are set as 0.10% for standard pools. These fees are collected in the token being traded and then converted into DYM. After converting to DYM, the protocol swap fees are distributed as follows:

- 50% goes to RollApp creators

- 50% is burned, reducing the circulating supply of

DYM

| Parameter | Current value |

|---|---|

| LP Swap Fees | 0.20% |

| Protocol Swap Fees | 0.10% |

| - Royalties | 50.00% |

| - DYM burn | 50.00% |