Monetary Policy

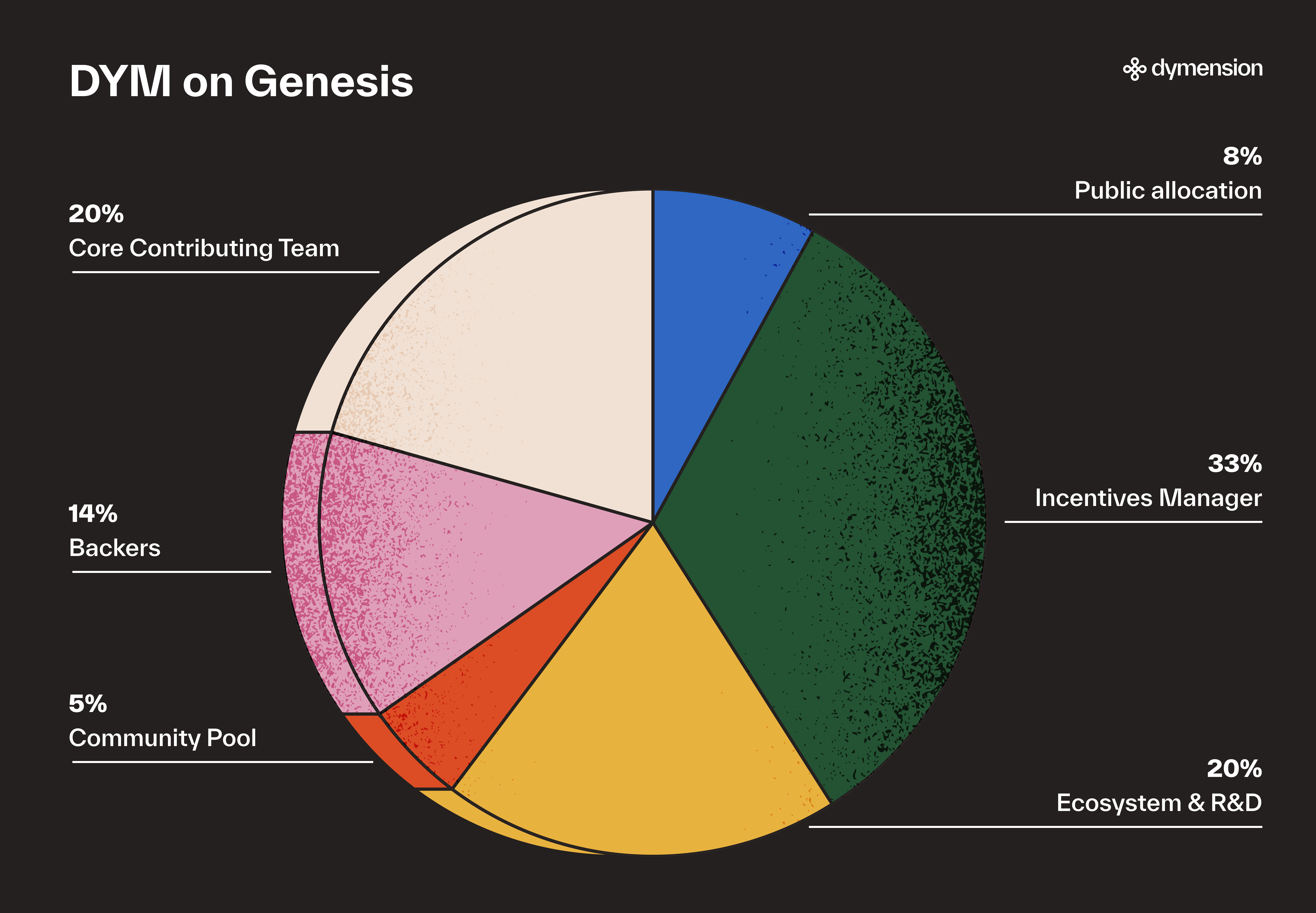

Genesis DYM Distribution

| Category | Description | % |

|---|---|---|

| Public allocation | Genesis Rolldrop and Incentivized testnet | 8% |

| Ecosystem and R&D | Allocated to the Dymension Foundation for growing the ecosystem and R&D while ensuring long-term interests | 20% |

| Incentives Manager [Onchain DAO] | Holding and distributing protocol owned funds for the purpose of RollApp Credit Streams, Rolldrop Seasons, and AMM Incentives | 33% |

| Community Pool [Onchain DAO] | Acting as the long-term treasury of the Dymension protocol | 5% |

| Backers | Reserved for partners who provided funding and support | 14% |

| Core Contributing Team | Reserved for the early contributing team for past and future contributions | 20% |

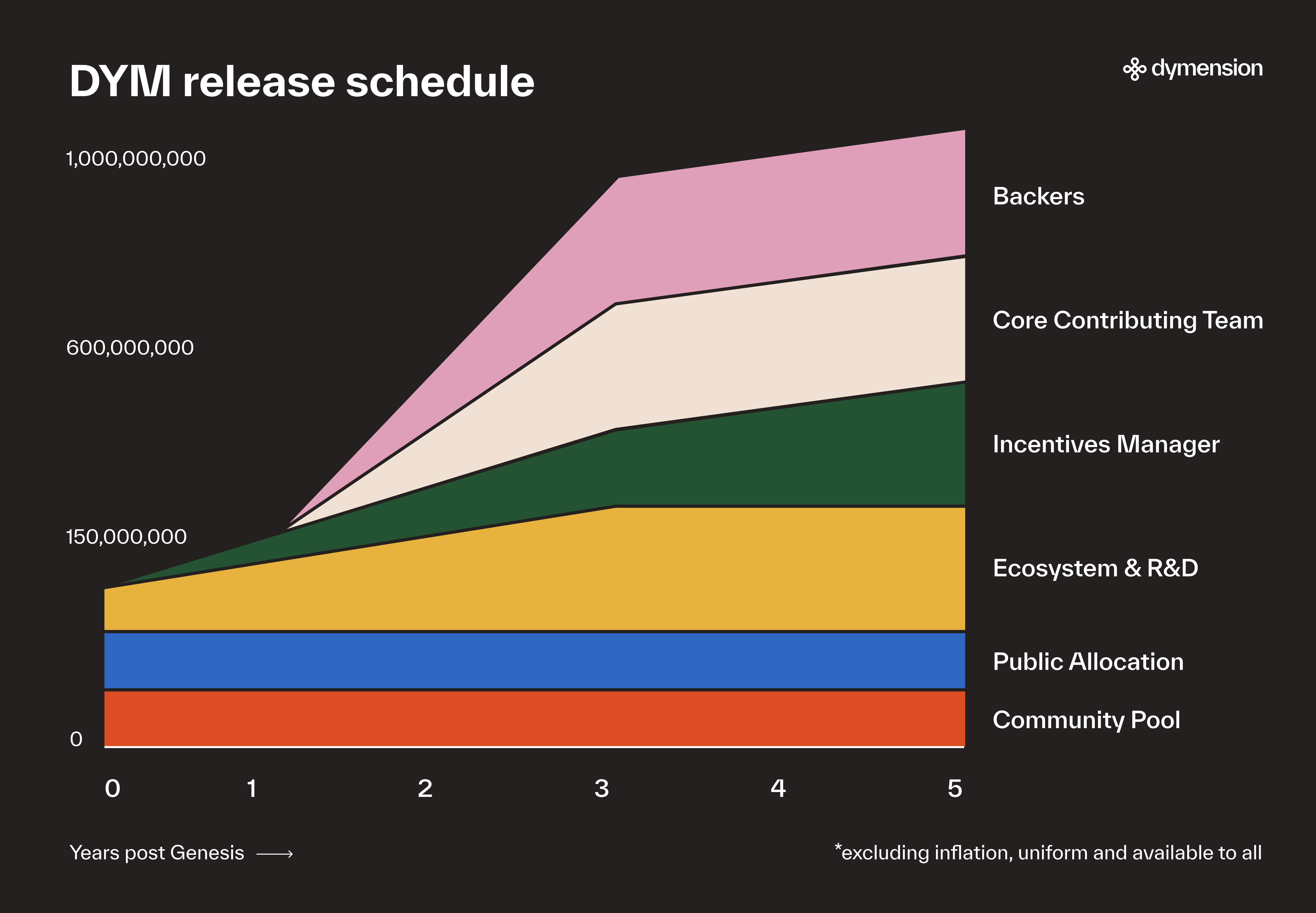

Unlock Schedules

| Category | Unlock Schedule |

|---|---|

| Genesis Rolldrop | Fully unlocked at genesis |

| Incentivized Testnet* | Fully unlocked at genesis |

| Incentives Manager [Onchain DAO] | Available to governance at genesis (non-circulating) |

| Community Pool [Onchain DAO] | Available to governance at genesis (non-circulating) |

| Backers | 12-month lockup, followed by a 24-month linear vesting |

| Ecosystem and R&D | 33% available immediately, remaining vests linearly over 3 years |

| Core Contributing Team | 12-month lockup, followed by a 24-month linear vesting |

* Validator participants in the incentivized testnet are subject to a 12-month lockup, followed by a 24-month linear vesting.

All of the token supply (both locked and unlocked) is eligible for staking.